Do Dash Cams Reduce Insurance?

Installing a dash cam in your car means you can feel protected on the roads, provide evidence if an incident happens and take advantage of the additional features that come with them, whilst also being eligible for a reduction in insurance premiums.

All leading motor insurers are now accepting dash cam footage as evidence to be used in the event of a claim, some insurers even offer annual discounts of up to 20% to drivers who use a dash cam.

How do dash cams help reduce insurance premiums?

Using a dash cam enables insurance companies to accurately and quickly establish liability of fault, using video footage to act as an independent witness to settle disputes.

One example is “crash for cash” when another driver brakes in front of you purposely to make a claim against you. Currently, these scams add £50 to everyone’s premium, resulting in a total cost of £392 million. As a dash cam owner, you can combat this fraud as you will always have an independent witness to any incident and be able to prove exactly what happened.

What discount is available for using a dash cam?

There are many ways a dash cam can benefit you financially. Firstly, there is the initial saving on your insurance. For young drivers, especially with high premiums a 25% saving can be a considerable amount of money.

Nextbase has teamed up with MyFirstUK insurance to offer up to 30% discount to all Nextbase Dash Cam owners. Visit our Insurance Hub to learn more about this revolutionary offer.

AXA and Swiftcover could also offer varying discounts depending on

your details when you use a Nextbase Dash Cam. Even for others with premiums of

£500, this still can mean a saving of £100 which can easily cover the cost of a

dash cam.

It’s not just the savings when you buy your insurance that people with a dash

cam are keen to use. If you are ever in an incident, there is also the fact

that the dash cam footage can be used to prove you were not at fault and

therefore save your No Claims Discount.

Nextbase have recently surveyed the top 41 major insurers and all now accept

dash cam footage as proof of an incident. So no matter who your insurer is, a

dash cam can stop you from losing this discount that you may have spent years

building up. For many people, your No Claims Discount can be a significant

saving on your policy with some being around 75%.

How to use dash cam footage for insurance claim?

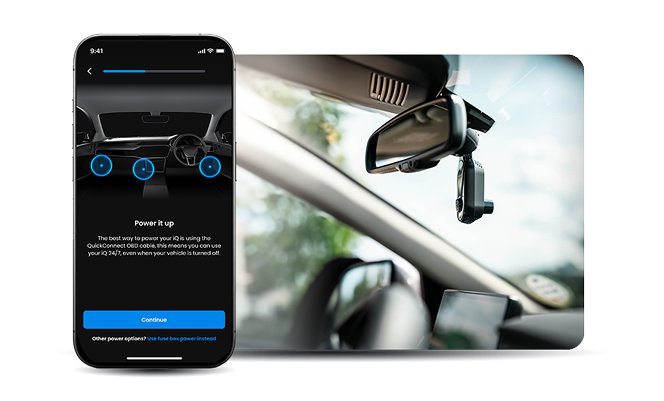

To prove what happened in the event of an insurance claim, you can simply send the dash cam footage directly to your insurer for viewing. This can easily be done using the Nextbase Cam Viewer App (for Wi-Fi-enabled models), via an email file transfer or by physically sending the SD card.

Which (which.co.uk) surveyed 2,111 British motorists who have made an insurance claim in the last two years. Finding that 20% of these drivers own a dash cam; of which 18% have used a dash cam as evidence in a claim.

This can be done by simply sending the Dash Cam footage directly to your insurer to be used in a claim for quicker settlement, or even submitted to the Police if it needs to be used as evidence in court. Most insurance companies are more than happy to use Dash Cam footage to resolve a claims case.

Do you need to tell insurance if you’re installing a dash cam?

Whilst this may differ depending on the insurance company you choose, in most cases, you don’t have to declare that you have a dash cam — they’re typically seen as a personal accessory. However, by telling your insurance company that you have a dash cam, you might be eligible for a discount that you otherwise might not be aware of.

Another consideration is that if you’ve stated you have a dash cam and don’t provide footage of an accident, your insurance may ask you to pay back any discount you’ve previously had.

To ensure transparency, if you have a dash cam, mention it to your insurance company — you might find yourself with a discount.

Are dash cams worth it?

Even if you choose an insurer that doesn’t offer a discount for having a dash cam installed, there are still a range of benefits that come with choosing to install a Nextbase model into your vehicle:

Promotes safer driving

Having a dash cam installed in your car, whether front-facing or rear-facing, can help prevent accidents through safer driving. When others on the road see a dash cam, they often drive more carefully to avoid being caught on camera driving recklessly. Rear dash cams can help deter tailgaters, which is one of the main causes of accidents on the road.

Speeds up claims progress

When you have clear evidence of an incident that’s taken place on the road, you can send it to your insurer to confirm liability. This can speed up the overall claims process as it eliminates the need to go back and forth between drivers to determine who was in the wrong.

Protection when parked

Dash cams can also protect you when parked, so if your car is bumped when you’re not around, you’ll know what happened and when. You can park with peace of mind with a dash cam installed.

Fleet management

Businesses that need a fleet of cars to run smoothly can benefit from dash cam installation. It allows managers to keep track of their vehicles, and their drivers' habits on the road. It also reduces the risk of accidents and therefore the costs associated with vehicle maintenance.

Installing a dash cam in your vehicle comes with a range of benefits as listed above. They can also help you save money on your car insurance and reduce maintenance costs by promoting safe driving and being used as evidence for liability.

Choose from a range of the most advanced dash cams at Nextbase, including iQ smart dash cam, with mid-level and entry-level options available to suit you.

Dash cam insurance discount FAQs

How do dash cams reduce insurance costs?

Dash cams can provide insurers with clear evidence of fault in accidents, helping to speed up claims processing and reduce fraudulent claims. This increased transparency can lead to lower premiums for drivers with dash cams installed.

Do all insurance companies offer discounts for dash cam users?

Not all insurance companies offer discounts specifically for dash cam users, but many recognise the benefits of dash cams in reducing claims costs. As listed above, many insurance providers give discounts when drivers have a dash cam installed — but it’s always best to check before you decide on an insurance company.

Are there specific types of dash cams that insurance companies prefer?

Insurance companies typically prefer dash cams that capture high-quality video and have features such as GPS tracking, G-sensor technology (which detects sudden impacts), and parking mode. It’s always best to check with your chosen insurer whether they require you to have a certain standard of dash cam to access discounts.

Which type of dash cam should I choose?

There’s a range of options to choose from at Nextbase. All of our dash cams record HD footage, so to narrow down your choices, you should consider your budget. Smart dash cams are some of the most advanced on the market, featuring a range of modern features. Mid-level dash cams are more affordable, boasting high-resolution recordings.

The most affordable, entry-level dash cams may not have as many features as the smart dash cams but they can still record clear, stable images to use when you need it.